Rows of dead batteries stretch across some 30 acres of high desert, organized in piles and boxes that are covered to shield them from the western Nevada sun. This vast field is where Redwood Materials stores the batteries it harvests from electric vehicles, laptops, toothbrushes, and the litany of other gadgets powered by lithium-ion technology. They now await recycling at what is the largest such facility in the country.

Redwood was founded in 2017 by former Tesla executive JB Straubel and says it processes about three-quarters of all lithium-ion batteries recycled in the United States. It is among a growing number of operations that shred the packs that power modern life into what is called “black mass,” then recoup upwards of 95 percent of the lithium, cobalt, nickel, and other minerals they contain. Every ounce they recover is an ounce that doesn’t need to be dug from the ground.

Recycling could significantly reduce the need to extract virgin material, a process that is riddled with human rights and environmental concerns, such as the reliance on open pit mines in developing countries. Even beyond those worries, the Earth contains a finite source of minerals, and skyrocketing demand will squeeze supplies. The world currently extracts about 180,000 metric tons of lithium each year — and demand is expected to hit nearly 10 times that by 2050, as adoption of electric vehicles, battery storage, and other technology needed for a green transition surges. At those levels, there are only enough known reserves to last about 15 years. The projected runway for cobalt is even shorter.

Before hitting these theoretical limits, though, demand for the metals is likely to outstrip the world’s ability to economically and ethically mine them, said Beatrice Browning, an expert on battery recycling at Benchmark Mineral Intelligence, which tracks the industry. “Recycling is going to plug that gap,” she told Grist.

Given these trends, the most remarkable thing about Redwood isn’t that it exists, but that it didn’t exist sooner. As the United States belatedly embraces the economic, national security, and environmental benefits that domestic battery recycling offers, it is trying to claw back market share from counties like South Korea, Japan, and especially China, which has a decades-long head start.

“There is this race in terms of EV recycling that people are trying to capitalize on,” said Brian Cunningham, program manager for battery research and development at the Department of Energy. “Everybody understands that, in the long term, developing these robust supply chains is going to be incredibly reliant on battery recycling.”

Straubel’s recycling journey began while he was still the chief technology officer at Tesla, which he co-founded with Elon Musk, and three others, in 2003. One of his roles was establishing the company’s first domestic battery manufacturing facility, Gigafactory Nevada. Material for Tesla’s batteries came from mines around the world, and Straubel understood that the trend would accelerate alongside demand for EVs, which has quintupled in number in the U.S. since 2020. He also knew that, in the years ahead, a growing number of electric vehicles would reach the end of their lives. According to consulting firm Circular Energy Storage, the world’s supply of retired batteries is expected to grow tenfold by 2030.

“[We] need to be planning ahead and really keeping an eye toward what that future looks like, to be ready to recycle every one of those batteries,” Straubel said in 2023. “The worst thing we could do is go to all this destruction and trouble to mine it, refine it, build the product and then throw it away.”

Justin Sullivan / Getty Images

Last year, Redwood says it recycled 20 gigawatt-hours of lithium-ion batteries, or the equivalent of about a quarter-million EVs, generating $200 million in revenue. In addition to its headquarters in Carson City, Nevada, Redwood is building a campus in South Carolina. It isn’t alone in looking to expand. Ascend Elements, Cirba Solutions, Blue Whale Materials, and Li-Cycle are among a number of recyclers operating, or planning to operate, facilities in at least nine states across the country. More than 50 startups worldwide have attracted billions in investment in recent years. (Much of this outlay was driven by Biden-era legislation that Republicans are considering repealing, though it remains unclear just what such action might mean for spending already planned or underway.)

Despite the boom, the reuse revolution won’t come quickly.

Benchmark projects that recycled lithium and cobalt will account for a bit more than one-quarter of the global supply of those metals by 2040. A closed system in which battery manufacturers use only recycled material is considerably further off, because any increase in the number of old packs available to recycle will be outstripped by the need for new ones.

Global demand for EV batteries, for example, is growing by about 24 percent per year and won’t level off until sometime after 2040 — the point at which Benchmark’s forecast ends and growth is still forecast at 6 percent per year. The battery powering an EV can last well over a decade or more, so there will be a lag before the supply of recycled material catches up to demand.

Even today, the world’s recycling capacity outpaces the supply of batteries available to recycle, leaving everyone clambering to find more. That has meant waiting for EV batteries to reach the end of their lives, and attempting to recycle the small batteries in everyday gadgets that are often trashed. The dearth of material available for recycling is often attributed to the idea that only 5 percent of lithium batteries make it to companies like Redwood Materials. But the provenance of that number, cited everywhere from the Department of Energy and Ames National Laboratory to The New York Times and Grist, is murky.

“If you ever ask, ‘Where did that 5 percent number come from?’ no one can really track back to the data,” said Bryant Polzin, a process engineer at Argonne National Laboratory. Like other Department of Energy employees or affiliates quoted in this story, he spoke to Grist before President Trump was inaugurated. “I think it was just kind of a game of telephone.”

Argonne’s research pegs the recycling rate for all lithium-ion batteries originating in the U.S. at 54 percent — 10 percent domestically and 44 percent in China — though it notes that data reliability remains an issue. Even that number, though, falls considerably short of what’s possible: 99 percent of lead acid batteries, like those used to start cars, in the United States are recycled, according to the Battery Council International trade association.

CFOTO / Future Publishing via Getty Images

Redwood works with many automakers, including Toyota, BMW and Volkswagen, to gather EV batteries, and goes into the field to collect others from automotive repair shops, salvage yards, and the like. Policy tweaks could help recyclers acquire more. In California, for example, a state working group recommended more clearly delineating when various entities in the supply chain — from the battery supplier and auto manufacturer to a dismantler or refurbisher — are responsible for ensuring a battery is recovered, reused, or recycled. This, the report said, could reduce the risk of “stranded” resources.

So far, though, this seems to be a rare occurance. The much bigger hindrance to EV recycling in the U.S. is simply that there aren’t enough old batteries to meet the demand for new ones. As that waiting game unfolds, recycling those often discarded as household waste could help bridge the gap.

Small lithium-ion batteries power everything from phones and electric toothbrushes to toys. By Benchmark’s estimate, about 5 percent of virgin lithium is used in consumer devices, but when they die, many of them are squirreled away in a drawer or trashed.

“A lot of household stuff does get chucked in the waste, and they’re not getting recycled,” said Andy Latham, the founder of Salvage Wire, a consulting firm focused on automotive battery recycling. Beyond being wasteful, dropping old batteries in the trash can be dangerous; scores of garbage trucks in cities from New York to Oregon have caught fire in recent years due to improperly disposed e-waste.

Data on just how much lithium is simply thrown away or hoarded remains elusive. But Latham says, in the short-term, batteries in portable electronics are “probably just as much, if not more of a factor” as those in EVs when it comes to advancing recycling. Redwood Materials, for one, is hoovering up as many as it can. It works with nonprofits and others to funnel them to its Nevada campus and hopes to establish drop-off locations at big-box retailers, similar to can and bottle collection in some states.

“Collection is definitely the biggest challenge,” said Alexis Georgeson, Redwood Materials’ vice president of government relations and policy. “It’s really a problem of how you get consumers to clean out their junk drawers.”

How to get rid of your e-waste

Until more people do that, recyclers count on a somewhat ironic source of material: Scraps from factories that make new batteries. One of Redwood’s primary feedstocks are the bits and pieces left over during the manufacturing process in places like Tesla’s Gigafactory, Georgeson said. Benchmark estimates that such leftovers represent about 84 percent of the material all battery recyclers use today.

The authors of the Argonne paper underscored how vital this material is: “If no scrap was available,” they wrote, “the development of the U.S. recycling industry might be significantly delayed.”

As more EVs hit the end of the road, consumer electronics are collected in greater numbers, and battery manufacturing yields less scrap as it grows more efficient, the composition of the material will adjust. New battery technologies could also have an impact, with emerging solid-state batteries, for example, expected to create more production waste in the short term but less in the long term. But few doubt recycling will be a thriving business that could help the country cut carbon emissions and decrease its dependency on places like China, Chile, and the Democratic Republic of the Congo for increasingly vital minerals. It’s a future that American policymakers are trying to shape, hasten, and prepare for.

Although under threat from President Donald Trump’s administration, both the Biden-era bipartisan infrastructure law and Inflation Reduction Act, or IRA, explicitly aim to bring battery manufacturing to the United States. They provided billions of dollars in grants and tax credits to incentivize building out domestic capacity (often in Republican congressional districts). The consumer-facing EV tax credit also requires that manufacturers source a minimum amount of both minerals and components locally. The government has been investing hundreds of millions of dollars in battery recycling as well, including Department of Energy support for everything from collection systems for small electronics to research into improving recycling technology.

“The work that we are funding is to really make those processes more efficient and economical,” said Jake Herb, technology development manager at the agency’s Vehicle Technologies Office. One success story is Ascend Elements, which Department of Energy funding helped grow from a Worcester Polytechnic Institute startup into a major player in the domestic industry. The department offered to loan Redwood Materials $2 billion to expand its factory, though the company declined the additional investment and says it has not accepted any federal funding. A robust domestic industry ensures that“we’re able to reclaim more materials [and] keep more of those materials domestic in the U.S,” Herb said.

Several challenges remain as the country sprints toward that goal.

One hurdle is figuring out when recycling is the best option. Argonne National Laboratory’s “battery material use hierarchy” puts recycling near the bottom of its list of possible outcomes. It’s better to find alternate uses for batteries, especially those from EVs, like refurbishing them for use in another car or directing them to less intensive applications, such as for energy storage.

“It would provide a much more economical solution to consumers,” said Vince Edivan, executive director of the Automotive Recyclers Association.

Still, this so-called “second life” market remains nascent in the U.S. Edivan says automakers could boost it by making it easier for salvage yards to assess a battery’s condition to determine whether it can be reused or should be recycled. They often consider that information proprietary, he said. “We’re shredding perfectly good batteries because we don’t know the state of health.”

Battery recycling comes with another danger as well: fire. Dismantling and recovering batteries involves highly volatile processes. Last fall, a recycling plant in Missouri sparked a blaze that led many residents to evacuate. Thousands of dead fish washed up downstream of the plant.

It’s somewhat hazy who is supposed to regulate this rapidly growing industry. The Environmental Protection Agency considers lithium-ion batteries hazardous waste, which dictates how they should and shouldn’t be disposed of, but doesn’t directly address recycling. In 2021, Argonne signed on to help develop lithium recycling standards, though the status of that effort remains unclear. The task will likely fall to a patchwork of federal, state, and local authorities, which must keep the public both safe and confident in a process that will be critical to the country’s — and the climate’s — future.

Perhaps the biggest challenge to creating a full-cycle loop in the United States is that before any reclaimed material can be used in a battery, it must be refined into an intermediary product, such as cathode, which makes up approximately 40 percent of a battery’s value. “You can’t send lithium to a Gigafactory,” said Georgeson. “It is like sending sand to a computer factory.”

At the moment, no one is making cathode in the U.S. at scale — manufacturers are buying it from Asia. Redwood, Ascend Elements, and others are ramping up cathode facilities that should be online in the coming years (Panasonic plans to use Redwood cathode at its new battery plant in Kansas). But, for now, they are frequently selling their raw material abroad.

Georgeson sees federal policy as key to helping, or hindering, efforts to plug the cathode hole in the supply chain. One impediment has been a Treasury Department ruling that allows cathode sourced from allied countries to also qualify for the EV tax credit. That, she said, has pushed billions in business and investments to countries like South Korea instead of the United States.

It remains unclear exactly how the new administration will impact the industry, but President Trump could certainly upend it. If Congress rolls back the IRA’s investment and production tax credits, it could significantly handicap America’s burgeoning recycling buildout. On the other hand, tariffs, particularly aimed at China, could tip the economic scales toward American producers and recyclers by making imported batteries and their components more expensive.

Redwood, for one, is optimistic that its goal of onshoring both battery recycling and cathode production aligns with Trump’s goals of putting “America first.” Straubel has said that the Trump administration could do a lot to encourage a more robust domestic supply chain, including making the battery origin requirements of the EV tax credit more stringent — rather than scrapping the incentive entirely.

Getting the policy wrong, the company argues, will put the U.S. at the mercy of others in a future where battery recycling will only become more critical.

Blanca Begert contributed reporting to this story.

Read the full mining issue

A guide to the 4 minerals shaping the world’s energy future

Chile’s lithium boom promises jobs and money — but threatens a

critical water source

Most critical minerals are on Indigenous lands. Will miners respect

tribal sovereignty?

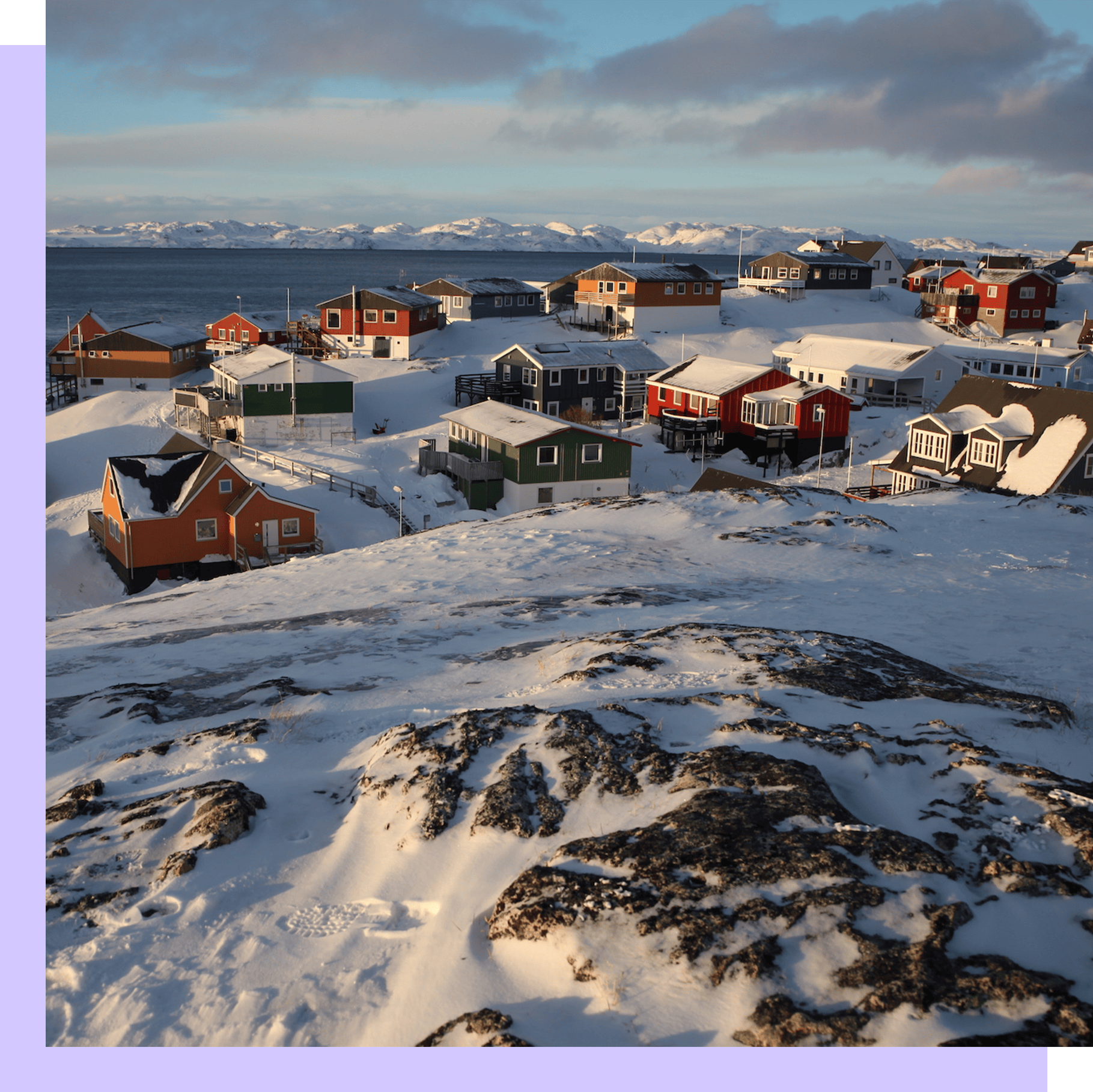

The energy transition could turn Greenland into a mining mecca. Would

it be for better or for worse?

Digging for minerals in the Pacific’s graveyard: the $20 trillion

fight over who controls the seabed

Mining is an environmental and human rights nightmare. Battery

recycling can ease that.

Tradeoffs of the green transition: Is mining critical minerals better

than extracting fossil fuels?

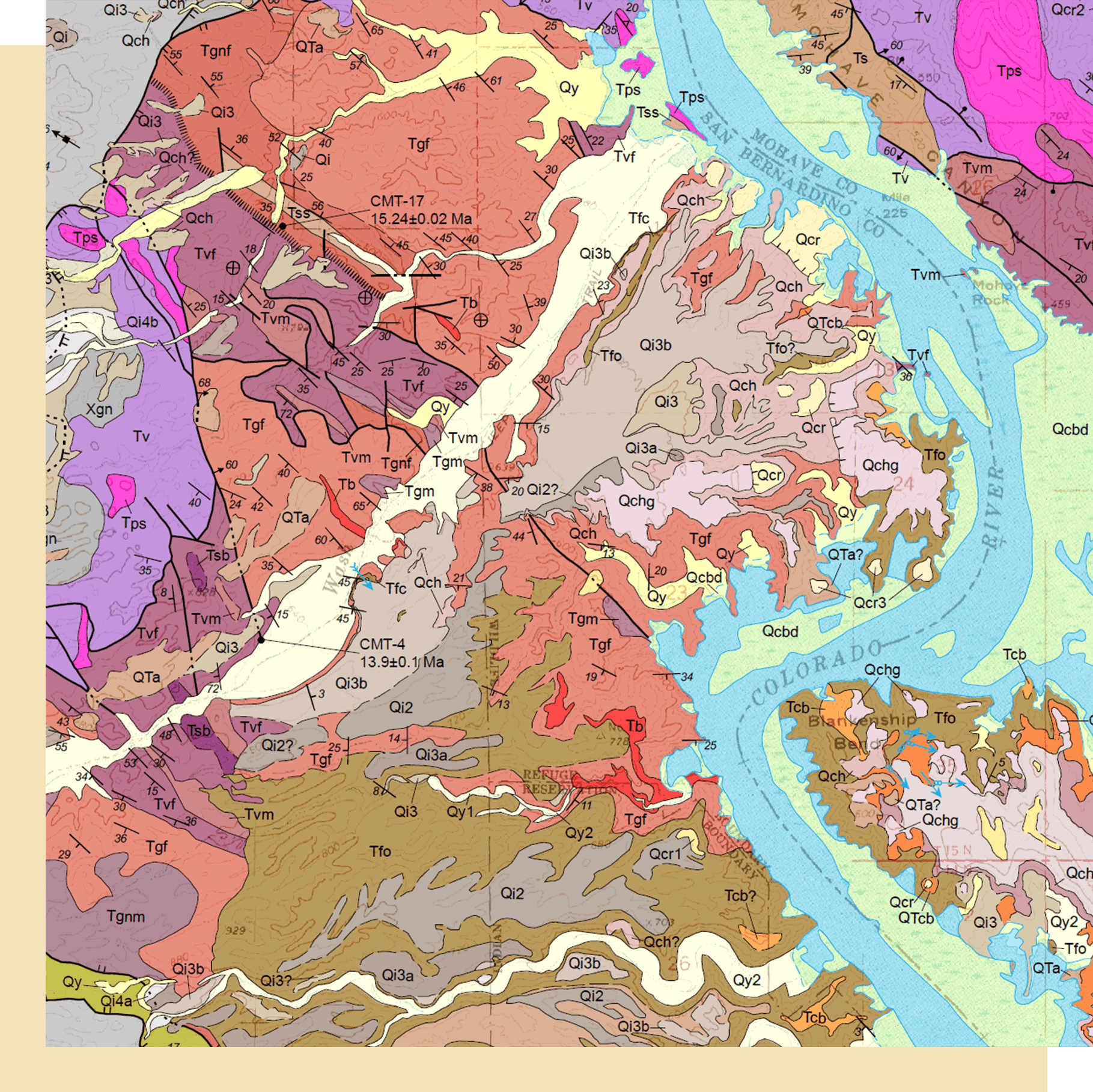

Why Biden and Trump both support this federal mineral mapping projecty

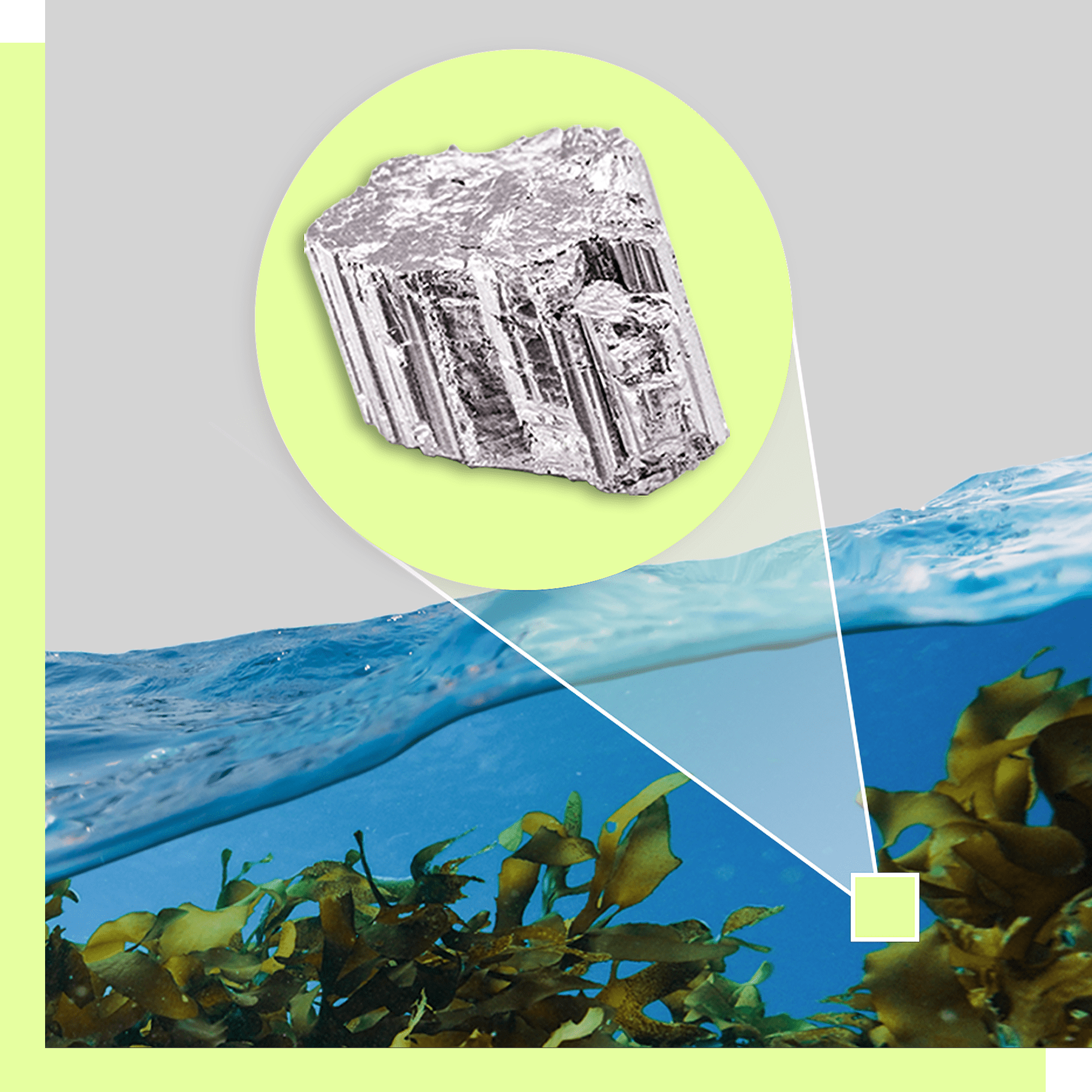

The weirdest ways scientists are mining for critical minerals, from

water to weeds

In the race to find critical minerals, there’s a ‘gold mine’ literally

at our shoreline

This story was originally published by Grist with the headline Mining is an environmental and human rights nightmare. Battery recycling can ease that. on Mar 26, 2025.

Recycling provides economic, national security, and environmental benefits. But the United States is playing catch-up to Asian countries, particularly China. Energy, Science, Solutions, Technology Grist