Invest Latest news RSS

Michael Burry’s latest Q1 filings show he wagered $7.6 million on gold via a fund that allows him to redeem units in actual physical gold.

Legendary investor Micheal Burry’s bet against the housing market in the 2008 financial crash netted him $700 million—the saga was chronicled in the award-winning film “Big Short.”

Since the global financial crisis, Burry’s notable investment decisions also showcased strategic foresight. He invested in water assets, predicting future scarcity, and GameStop before it became a meme stock.

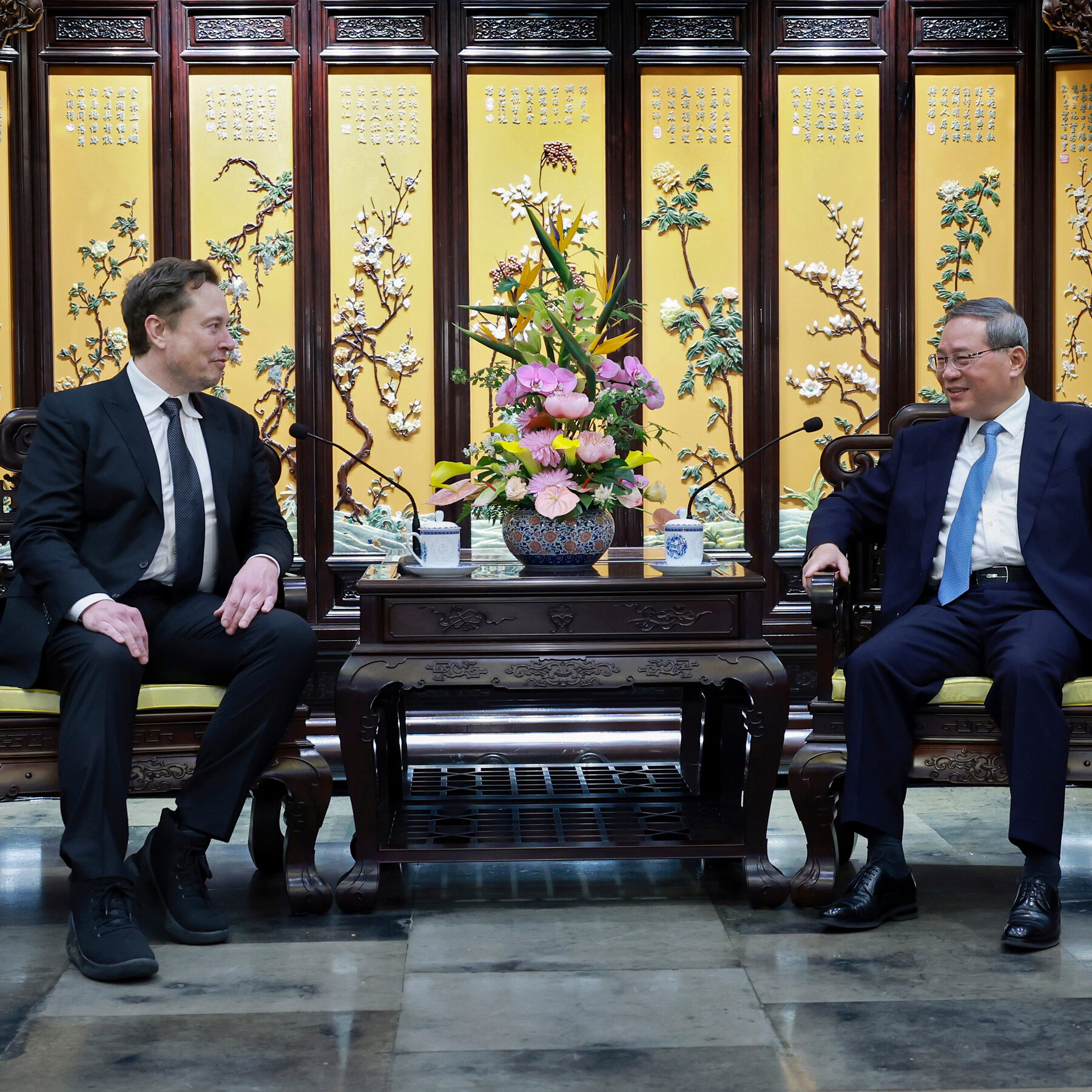

He has also wagered against Elon Musk’s Tesla, Cathie Wood’s Ark Innovation ETF, and Blackrock’s iShares Semiconductor ETF, which has Nvidia as one of its top holdings.

In the latest 13-F filing released last week, the metalhead’s Scion Asset Management revealed making several adjustments to multiple trade positions, but what stood out was buying over 440,000 units of the Sprott Physical Gold Trust valued at $7.6 million.

Blurry’s new position in physical gold via the trust is the firm’s top buy in Q1 2024 and currently accounts for 7.4% of his portfolio.

Burry’s latest investment in the gold trust returned 16% in value in the first three months of 2024, outperforming the 11% gains showcased by the S&P 500. This trust now holds the fifth-largest allocation in Scion’s portfolio.

Simply put, it is a closed-end fund that offers investors exposure to gold without the hassles of handling and storing physical gold.

Burry made several changes to his portfolio last quarter. He increased his holdings in JD.com to $9.9 million and Alibaba to $9 million while offloading stakes in tech firms like Oracle, Google, and Amazon.

However, he increased his stake by $4.4 million in China’s tech firm Baidu to 4.1% of the total portfolio while adding $5.1 million to First Solar in Q1. The asset management firm’s total investments increased to $103.5 million from $94.6 million over the quarter.

Burry’s notable bet on bullion as a buffer against market volatility and inflation aligns with American billionaire hedge fund manager John Paulson, who leads New York-based Paulson & Co. In 2021, he projected sticky inflation and aggressive rate hikes by the US Federal Reserve would compel investors to dump cash for gold and similar assets with limited supply.

Since then, gold prices have jumped to record levels above $2,400 per troy ounce in recent weeks from $1,800. Both investors remain bullish, believing that gold will benefit in the foreseeable future.

Gold can be relevant for any investor portfolio, given its intrinsic store of value due to limited supply and universal demand. The precious metal is a time-tested tangible asset that has surged in price to record highs during major recessions in the last 50 years.

Its negative correlation with the stock market, high exchangeability worldwide, and easy access complement its surging demand as investors often purchase gold for value appreciation and to hedge against inflation and the devaluation of fiat currencies like the US dollar.

Why did Burry invest in physical gold when there are low-fee exchange-traded funds (ETFs) and gold mining stocks? The Sprott fund offers direct exposure to gold bullion without the operational and management risks or regulatory challenges associated with mining companies, which impact mining stock prices.

Many gold mines worldwide are present in politically sensitive areas. Investors in the Sprott fund buy real gold stored in secure vaults and can redeem their units for physical gold, a feature most ETFs don’t offer. This move by Burry will allow him to redeem his units in equivalent gold bullion in case of an extreme market crisis.

The appeal of investing in gold may fade and lead to a price correction if inflation continues its downward trend and the US Federal Reserve begins trimming interest rates. However, gold’s intrinsic value and easy access amid persistent stock market upheavals in this new decade may position it for steady value appreciation.

Disclaimer: Our digital media content is for informational purposes only and not investment advice. Please conduct your own analysis or seek professional advice before investing. Remember, investments are subject to market risks and past performance doesn’t indicate future returns.