Australian businesses have entered 2025 with a surprising resilience, shaking off last year’s insolvency spike—at least for now.

New data from CreditorWatch’s Business Risk Index (BRI) signals that businesses navigated the end of 2024 with more resilience than anticipated. However, experts caution that these gains may be short-lived as global economic pressures, particularly the Trump administration’s proposed tariff regime, loom large.

A drop in insolvencies and payment defaults

CreditorWatch’s data shows a notable decline in both trade payment defaults and first-time insolvencies reported to ASIC in January, even after adjusting for seasonality. Trade payment defaults fell to their lowest level since September 2024, while first-time insolvencies were at their lowest since February 2024.

This marks a significant shift from the rising insolvency rates seen throughout much of last year.

Several factors contributed to this improvement:

- Stronger consumer spending: Retail sales and consumer confidence have risen, thanks in part to the continued impact of the July 2024 tax cuts and cost-of-living support measures. A robust labor market has also provided stability.

- Interest rate relief: The Reserve Bank of Australia (RBA) recently cut the official cash rate by 25 basis points to 4.1%—the first reduction in five years. This is expected to ease financial pressure on both consumers and businesses.

- Improved business confidence: The combination of stronger spending, lower interest rates, and inflation moderation has provided businesses with a temporary reprieve.

However, the economic outlook remains uncertain, with persistent cost pressures and potential global disruptions on the horizon.

US tariffs could upend business stability

One of the biggest concerns for Australian businesses is the potential impact of the Trump administration’s proposed tariff regime. While Australia may avoid direct tariff impositions due to its trade deficit with the US and strong Pacific alliance, the global repercussions could still be significant.

If enacted, the tariffs could lead to:

- Higher prices in the US, driving up inflation and potentially delaying further interest rate cuts.

- A stronger US dollar and a weaker Australian dollar, which could increase the cost of imports.

- Supply chain disruptions as global trade routes shift, potentially increasing shipping costs for Australian businesses.

- An influx of tariffed goods from other countries into Australia at discounted prices, increasing competition for local manufacturers and wholesalers.

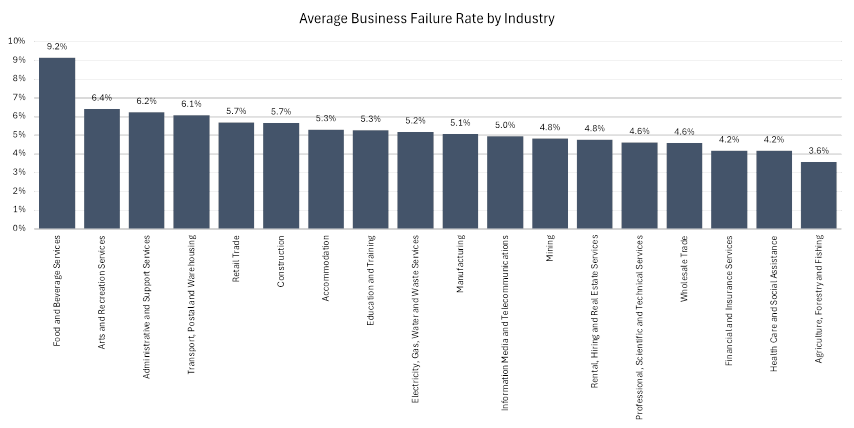

While the full effects remain uncertain, businesses—particularly those in manufacturing, transport, and wholesale—should prepare for potential headwinds. Despite overall improvements in business conditions, the Food and Beverage Services sector continues to struggle. A record 9.2% of businesses in the sector became insolvent, voluntarily closed, or were struck off ASIC’s register in the 12 months to January 31—an all-time high.

Several factors have contributed to this crisis:

- Rising operating costs, including rent, wages, insurance, and food prices.

- Consumers cutting back on discretionary spending due to cost-of-living pressures.

- A continued shift toward remote work, reducing foot traffic for city-based venues.

While the recent rate cut may offer some relief, a major turnaround in the sector will likely depend on broader economic conditions, particularly lower inflation and stronger consumer spending.

Regional insights: Which areas are at highest risk?

The highest-risk regions for business failure are concentrated in Western Sydney and South-East Queensland—areas often linked to the construction sector or lower-income demographics. Bringelly-Green Valley in Western Sydney currently has the highest forecasted business failure rate, at 7.8% over the next 12 months.

Conversely, businesses in inner-city Adelaide’s Norwood-Payneham-St Peters area are the least at risk, with a forecast failure rate of just 4.55%. Among the capital cities, Adelaide has the lowest CBD failure rate (5.01%), followed by Perth (5.21%), Brisbane (5.80%), Melbourne (5.93%), and Sydney (6.07%).

While the latest data suggests Australian businesses are starting 2025 in a stronger position, challenges remain. The RBA is forecasting a “soft landing” for the economy, with inflation moderating and interest rates potentially easing further. However, slower population growth due to migration policies could act as a drag on growth.

The biggest wildcard remains the US tariff policy. If broad-based tariffs are imposed for an extended period, global trade could face significant disruptions, adding uncertainty and cost pressures for Australian businesses.

For now, businesses should take advantage of the current improvements while keeping a close eye on external risks that could threaten stability in the months ahead.

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

Fresh data from CreditorWatch reveals a surprising shift: business failures, which surged last year, are now slowing. News, Business Dynamic Business