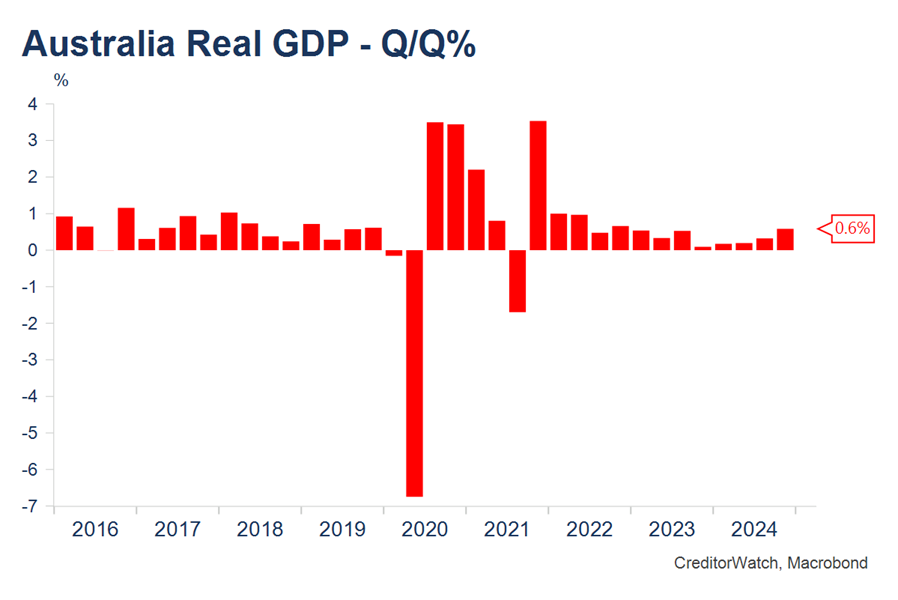

On March 5, 2025, Australia’s economic pulse was laid bare with the release of Q4 2024 GDP figures: a modest 0.6% growth quarter-on-quarter and a sluggish 1.3% year-on-year increase.

While growth has ticked up slightly through 2024, it’s far from robust, leaving Small and Medium Enterprises (SMEs) with both opportunities to seize and challenges to navigate. Yet, as CreditorWatch Chief Economist Ivan Colhoun emphasized, it’s not the GDP numbers themselves that will shape the future—it’s the shadow of President Trump’s looming tariff agenda that could redefine the economic landscape for SMEs over the next 12-18 months.

The GDP data paints a picture of an economy propped up by a mix of government intervention and natural fortune. Consumer spending got a boost from mid-2024 income tax cuts and government support packages, fueling retail, hospitality, and event-driven SMEs during Black Friday sales and sporting/music events. A bumper grain harvest powered agriculture and logistics, while public investment surged (+1.8% q/q, +8.1% y/y) into renewables, roads, and water—offering a lifeline to SMEs with government contracts. Services exports, particularly in pharmaceuticals and software, also shone, hinting at growth potential for tech-savvy small businesses.

But the story isn’t all rosy. Growth remains “very slow,” and productivity—down 0.1% in Q4 and 1.2% over the year—is a persistent thorn in Australia’s side. SMEs in construction, mining, banking, and education are particularly hamstrung by red tape and inefficiencies, driving up costs and eroding competitiveness. Meanwhile, residential construction faltered amid labor shortages and high material prices, and mining output weakened due to delays and closures in lithium and nickel sectors—bad news for SMEs tied to these industries.

The Tariff Cloud Looms Large

While today’s GDP figures offer a snapshot of mild improvement, they’re overshadowed by a far bigger issue: President Trump’s tariff threats. If implemented, high tariffs on trading partners—and retaliatory measures—could disrupt global supply chains, shrink export markets, and jack up costs for imported goods. For SMEs reliant on international trade, whether exporting to the U.S. or importing manufacturing inputs, this uncertainty is a ticking time bomb. Colhoun warns that until the tariff picture clarifies, businesses will grapple with heightened risk, and if tariffs hit hard, growth, employment, and consumer spending could take a nosedive.

What’s Ahead for SMEs?

For now, the Reserve Bank of Australia (RBA) is likely to stay the course, guided by its dual mandate of full employment and low inflation. With unemployment steady and inflation expected to ease toward target, a modest interest rate cut could come in May 2025—assuming Q2 CPI data cooperates. Lower borrowing costs would be a boon for SMEs looking to refinance debt or invest, but don’t expect a dramatic rate-cutting spree unless the economy falters further.

So, what does this all mean for Australia’s small and medium businesses?

For Australia’s small and medium enterprises (SMEs), the current economic climate offers a mix of opportunities and hurdles. On the upside, SMEs in infrastructure—like renewables or roads—or public services such as health and education can capitalize on robust government spending by positioning themselves for tenders, securing steady revenue streams. Retail and hospitality businesses should make the most of the tax-cut-driven consumer spending boost, though they’ll need to stay nimble if confidence wanes, while agriculture and logistics SMEs can leverage the bumper harvest wave, albeit with an eye on diversification given its fleeting nature. Tech-focused small firms in pharmaceuticals or software also have a shot at scaling up, particularly in export markets. However, challenges loom large: exporting SMEs or those reliant on imports must prepare for potential trade disruptions from Trump’s tariffs, possibly by diversifying markets or suppliers as a hedge. Productivity woes plague red-tape-heavy sectors like construction and mining, pushing businesses to boost internal efficiency—perhaps through technology—to remain profitable amid high costs and softening demand. Construction SMEs, in particular, face a tough slog with elevated input prices, while those tied to mining could see weaker demand. Finally, SMEs banking on government spending must watch for risks, as rising state debt or a federal election could shift priorities and pull the rug out from under them.

For SMEs, the GDP data signals a window of opportunity tempered by caution. The slight growth and potential rate relief offer breathing room to strengthen operations—whether that’s chasing public contracts, streamlining costs, or locking in financing. But agility is non-negotiable. Trump’s tariff wildcard could upend global trade, and SMEs must be ready to pivot—be it sourcing locally, targeting new customers, or stockpiling essentials.

Productivity remains the elephant in the room. With GDP per hour worked sliding, SMEs can’t wait for government reforms to cut red tape in construction, mining, or banking. Taking control—through process improvements or smarter tools—could be the edge they need to thrive. Australia’s economy is inching forward, buoyed by government spending and consumer support, but it’s a fragile footing. For SMEs, the real game-changer isn’t in today’s numbers—it’s in how they prepare for the uncertain world ahead. The next 12-18 months will test their resilience, but those who adapt to both domestic realities and global risks stand to come out stronger. In this climate, standing still isn’t an option.

Mid-2024 tax cuts lit up spending—retail and hospo rode the wave. But with Trump’s tariff train gaining speed, SMEs face new challenges News, Gdp Dynamic Business