By Liz Willen

For many high school seniors and others hoping to attend college next year, the last few months have become a stress-filled struggle to complete the trouble-plagued, much-maligned FAFSA, or Free Application for Federal Student Aid.

The rollout of this updated and supposedly simplified form was so delayed, error-ridden and confusing that it has derailed or severely complicated college decisions for millions of students throughout the U.S., especially those from low-income, first-generation and undocumented families.

The bureaucratic mess is also holding up decisions by private scholarship programs and adding to public skepticism about the value of higher education — threatening progress in efforts to get more Americans to and through college.

To see the impact in person, The Hechinger Report sent reporters to schools in four cities — San Francisco, Chicago, Baltimore and Greenville, South Carolina — to hear students’ stories. Because we found them through schools, most of those we interviewed had counselors helping them; for the millions of students who don’t, it’s an even more daunting task.

Do you already have financial aid but don’t understand your offer letter?

Try our Offer Letter Decoder, which will decipher your promised financial aid.

“It was stressing me every day,” said one San Francisco senior who was accepted to 16 colleges but could not attend without substantial financial aid. Some became so frustrated they gave up, at least for now. Others said they will turn to trade schools or the military.

Students whose parents are undocumented had special worries, including concern that naming their parents would bring immigration penalties (although the Family Educational Rights and Privacy Act forbids FAFSA officials from sharing family information).

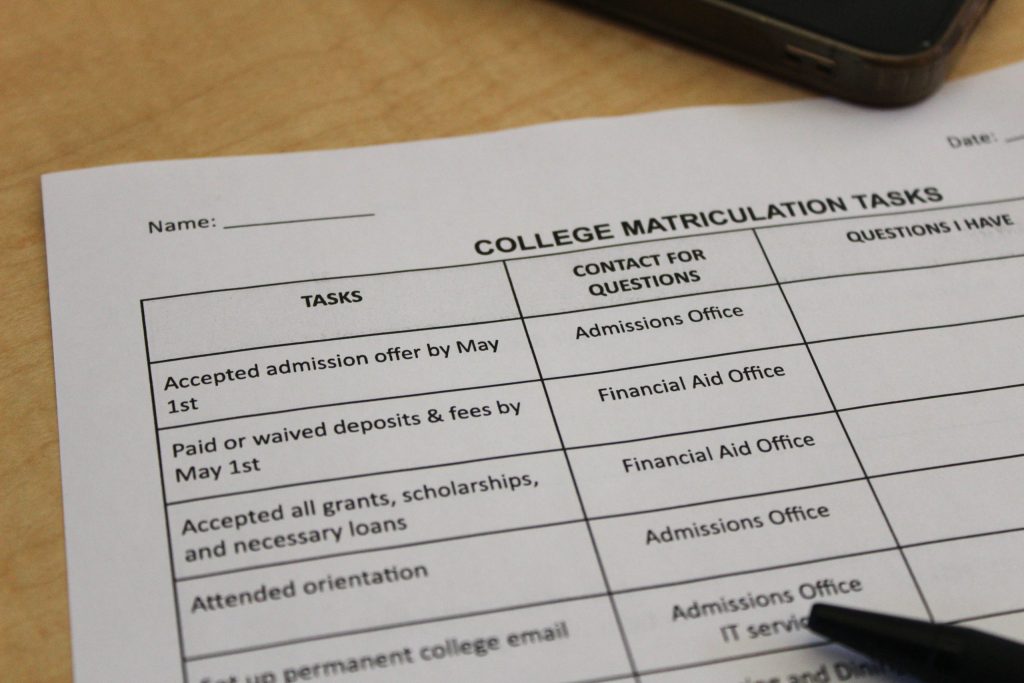

To give students more time to weigh options, more than 200 colleges and universities pushed back their traditional May 1 commitment deadlines, some until June 1, according to the American Council on Education, which keeps an updated list.

Despite heroic efforts by counselors and a slew of public FAFSA-signing events, just 40.2 percent of high school seniors had completed the FAFSA as of May 10, in contrast to 49.6 of last year’s seniors at the same time, according to the National College Attainment Network. The numbers do not bode well for college enrollment, nor for the many high school graduates who will not get the benefits of higher education.

SAN FRANCISCO

By Gail Cornwall

Damiana Beltran, a senior at Mission High School in San Francisco, has been working with Wilber Ramirez and other staffers from a nonprofit group that runs the school’s Future Center, where students get advice about college options and financial aid. It was touch-and-go whether her FAFSA form would be processed in time for her to attend her top-choice college. Credit: Gail Cornwall for The Hechinger Report

No one in Damiana Beltran’s family went to college, so she didn’t picture it in her future. But at the end of her junior year, “everybody” at Mission High School in San Francisco started talking about applying, so she did. San José State University admitted her, as did a few other schools. Excited, Beltran entertained visions of becoming a psychologist and showing her younger brother that “you don’t have to be from the wealthiest family” to go to college.

But the online FAFSA form wouldn’t let Beltran, who is a U.S. citizen, submit her application because her mother, who isn’t, doesn’t have a Social Security number. They tried using her individual taxpayer identification number but got an error message. Leaving the field blank didn’t work either. Beltran’s mother skipped work to get help at the school’s Future Center, but still, no dice. Eventually, they mailed in a paper version.

When May 1 passed with no offer of aid — or even an indication that her FAFSA had been received — Beltran decided to give up on attending the schools that would require her to pay for housing and a meal plan. If she went to nearby San Francisco State University, living at home would mean not asking her mother to take on debt. “I want to go to San José, but I don’t want to do that to her,” a teary Beltran said in April. “I think about it a lot during classes. During the whole school day, it’s in the back of my head.” She’s had trouble sleeping.

Her classmate Josue Hernandez also lost sleep over the FAFSA. It took him about a month and two submission attempts to access the part of the online form that would allow him to upload his undocumented parents’ IDs to verify their identity, he said. Once he did, it took about three more weeks to process. The senior, who had received local news coverage for being accepted into 16 out of 20 schools, said he thought to himself, “It was 12 years of hard work, and I finally got in, but I might not even be able to go.”

Hernandez’s other hope was scholarships. He cut back his hours at an after-school job to work on the applications and had to stay up late into the night to do the homework he’d pushed aside. Most of his free periods, including lunches, went to figuring out how to pay for college. “It was stressing me every day,” Hernandez said.

Related: Interested in innovations in the field of higher education? Subscribe to our free biweekly Higher Education newsletter.

Finally, the University of California, Berkeley, told him that his FAFSA had gone through, and financial aid would pay for almost everything; the SEED Scholars Honors Program would likely take care of the rest. “It’s finally over,” he said.

But it was not over for Jocelyn, another Mission High senior, who asked to be referred to by first name only, to protect her family’s privacy. She said that her father had been working two jobs waiting tables and her mother had been saving what she could from the household budget for quite some time; they had amassed $1,000. Jocelyn had saved $200 from working at an organic bagel shop. Room and board at San José State, her top choice too, runs $20,971 a year.

But that gap wasn’t her sole source of anxiety. By sending her undocumented parents’ names to the government in the FAFSA form, she feared she’d put them at risk, even though federal regulations forbid FAFSA officials from sharing private data with others.

Jocelyn (right) and Maria (left) are seniors at Mission High School in San Francisco, and both have had to deal with uncertainty about filling out the FAFSA form because their Spanish-speaking parents don’t have immigration documentation. Both also worried that delays in getting financial aid offers could mean they would have to defer going to college. Credit: Gail Cornwall for The Hechinger Report

Jocelyn, who wants to be a neonatal intensive care nurse, didn’t share the FAFSA difficulties with her dad, who only went to middle school in Mexico, or her mom, who never got to go to school. “They’re just gonna say, ‘Stay in San Francisco, problem solved,’ ” she said. But she already takes a class at City College of San Francisco, a community college, and finds the idea of enrolling there, with so many “grown adults,” discouraging. A friend of the family who did that and then transferred to a four-year school told Jocelyn she felt lonely having missed out on the first-year bonding. Now Jocelyn thinks thinking she’ll go to San Francisco State, live at home for a year, and then move into an apartment. But she’d still need financial aid to make that work. “It’s like, back to square one,” Jocelyn sighed — and then said she might forgo college and get a full-time job instead.

That’s not too far from Alessandro Mejia’s plan. As a senior in the challenging Game Design Academy at Balboa High School, he has the coding skills to major in computer science at one of the four-year colleges he got into. “College is my first choice,” Mejia said in late April, but he was eyeing trade school. Financing college “would just be much harder on our family,” he said, and “being an electrician or a car mechanic doesn’t seem too bad.” Of abandoning a tech career, he said, “I’m a little frustrated, but I feel like I developed a good work ethic in school so … it’s not completely a waste.”

School counselor Katherine Valle listened to Mejia with carefully concealed horror. “It’s shocking to hear,” she said. The Game Design Academy “is our hardest pathway, and we don’t have a lot of Latino males in it. To know he did that and is going to end up being a mechanic is just …” She couldn’t find words.

Source: National College Attainment Network Credit: Jacob Turcotte/The Christian Science Monitor

Valle said that for her students whose parents have white-collar jobs, the new FAFSA was everything promised: “easier process, less questions.” But it took kids in Mejia’s family income bracket many attempts to complete. He has the same potential as his wealthier peers, but those kids are “10 steps ahead,” she said. “It’s not fair.”

Mejia finally submitted his FAFSA on April 29. He said if he didn’t hear back by the new decision deadline for California State University institutions, May 15, he wouldn’t enroll.

With less than a week to spare, Mejia learned his FAFSA had been processed. He committed to San Francisco State. Jocelyn did, too, though she would have preferred San José State. For Beltran, though, the May 15 came and went; she was “still waiting for my FAFSA to come in,” she said, and hadn’t submitted an intent to register.

CHICAGO

By Matt Krupnick

Ashley Spencer, left, a counselor at Air Force Academy High School in Chicago, kept telling senior Samaya Acker “We’re getting there, we’re close,” as they navigated college and FAFSA applications amid the confusion caused by financial aid delays and errors. Credit: Matt Krupnick for The Hechinger Report

Samaya Acker stayed on top of her college plans all year. She applied for early action admission at 17 colleges, submitted her FAFSA application for financial aid two days after the window opened and came up with a backup plan to join the military, just in case.

Most of those preparations went well.

Acker, an 18-year-old senior at Air Force Academy High School on Chicago’s South Side who has “Power” tattooed in script on her arm, was accepted by 16 colleges (her top choice, the University of Chicago, was the only one to turn her down) and planned to spend a few months in the Air National Guard to help pay for college. But as scholarship and deposit deadlines approached, her FAFSA application was still classified as “pending” three months after she submitted it.

“It really put me on edge,” said Acker, whose high school years were interrupted first by Covid and then by the birth of her son halfway through her sophomore year, but who still is graduating with a weighted grade-point average over 4.0.

Samaya Acker, right, earned stellar academic credentials at Air Force Academy High School in Chicago, despite many obstacles, and was rewarded with a full scholarship that she will use to attend Loyola University. Credit: Matt Krupnick for The Hechinger Report

With Acker’s college decision deadlines looming, her counselor, Ashley Spencer, pulled her from class one day in mid-April to look over her options, whatever FAFSA results she got. “We are getting close to the end with you, slowly but surely,” Spencer said.

About a week later, Acker was awarded a Gates Scholarship, which pays the full cost of college attendance for high-achieving students from underrepresented groups. Acker, who is Black, accepted her offer of admission from Chicago’s Loyola University, where tuition alone is more than $52,000 per year. She plans to become an anesthesiologist. (The Gates Foundation is among the many funders of The Hechinger Report.)

A few miles away, a group of students at Hubbard High School in southwest Chicago were not as lucky.

The FAFSA delays have created unique challenges for students with undocumented immigrant parents — including students at Hubbard. At a late-April meeting with Dulcinea Basile, the school’s college and career coach, four seniors whose parents are undocumented said they had spent months waiting for the federal government to fix a glitch that prevented parents without Social Security numbers from submitting financial information. “How many times have we logged in and it says ‘FAFSA not available’?” Basile asked rhetorically.

The glitch was finally fixed, but all four were still waiting, in early May, to find out how much financial aid they might receive.

“There’s really not much I can do,” said Javier Magana, 18, who was still trying to figure out whether he could afford any of the colleges that had accepted him. “It’s definitely been frustrating because I’ve been trying my best.”

Dulcinea Basile, second from right, a college and career coach at Hubbard High School in Chicago, has been concerned for months that financial aid delays might cause some of her seniors — from left, Javier Magana, Octavio Rodriguez and Ixchel Ortiz — to forgo college. Credit: Matt Krupnick for The Hechinger Report

Ixchel Ortiz, 17, plans to go to a Chicago community college, but said if she didn’t receive financial aid, even that would have to wait.

Isaac Raygoza and Octavio Rodriguez, both 18, said they had a few four-year college options but likely wouldn’t be able to pursue any of them without a FAFSA answer.

Rodriguez said he had been repeatedly frustrated by trying to complete the FAFSA. “I would go home and wait 20 to 30 minutes on hold, and we didn’t get anywhere,” he said. In late April he was notified that he had misspelled his own name on the application; in mid-May, he was still waiting to hear whether he needed to re-apply from scratch.

“I’m slightly stressed,” he said in mid-May.

Raygoza said he had submitted his application on time but had failed to notice an error message that prevented it from being processed. He resubmitted it in late April.

“I was just shocked it was never processed,” he said. “I had to do it all again.”

All four said they would likely take a year off to work if they didn’t get aid.

BALTIMORE

By Kavitha Cardoza

LaToia Lyle works with students at the Academy for College and Career Exploration, a public high school in Baltimore. She’s a counselor from the nonprofit iMentor, which connects juniors and seniors to mentors for coaching on post-secondary planning. Many of her students are low-income and first-generation college prospects. Credit: Kavitha Cardoza for The Hechinger Report

At the Academy for College and Career Exploration in Baltimore, juniors and seniors have weekly class, run by the nonprofit organization iMentor, to help them understand and pursue postsecondary options, including colleges and various types of financial aid. Counselor LaToia Lyle worries about the long delays with FAFSA, because most of her students are low-income and will be first-generation college students, so they don’t always have someone to help them at home, and the delays could mean decisions had to be made quickly.

She helps them compare tuition costs and reminds them that housing deposits are not refundable and book fees add up. “Even gaps as small as $500 can make a difference,” she said.

For Zion Wilson and Camryn Carter, both seniors, the delays and the need to constantly try to log into FAFSA accounts that froze were frustrating, but both students said they were relieved when glitches with the forms meant their college commitment deadlines got pushed back.

“The last thing I wanted to do was make a fast-paced decision,” said Wilson, an ebullient 17-year-old with a wide smile. “I kept bouncing between different things. I felt the FAFSA delay gave me more of a chance to decide what I actually wanted to do.”

Zion Wilson said the extra time caused by FAFSA delays allowed her to decide against going to college as she’d originally planned. She got into several universities but decided to study information technology as a trainee through Grads2Careers, a Baltimore City program. Credit: Kavitha Cardoza for The Hechinger Report

She had applied for computer science programs at several colleges but was nervous about taking out loans. Even though Baltimore City Community College would be tuition-free for her, she worried she wouldn’t have enough money to spend if she wasn’t working. But her family wanted her to go to college, especially because her elder sister had enrolled but dropped out after the first year.

Wilson was admitted to her top three choices — BCCC, University of Maryland Eastern Shore and Coppin State University — but even with scholarships, she decided not to go. Instead, Wilson plans to go straight into the workforce through a program called Grads2Careers, where she will get training in information technology.

“It kind of sounded like I can just do the exact same thing that I would be doing if I went to college, but I can just start now versus waiting two years to start,” Wilson said. After a two-week training period, she will be paid between $15 and $17 an hour, she said.

In the end, she filled out her portion of the FAFSA, but told her parents not to do theirs. “Why make my parents do this long thing and put in their tax information, if I’m not going anywhere that requires it?”

Wilson is relieved not to have to think about college anymore. “I think I made the right choice, and having some money in my pocket will also be a good push for me to continue to advance up.”

Camryn Carter, a senior in Baltimore, got accepted with a full scholarship to the University of Maryland, College Park, his first choice. He called the FAFSA delays “a blessing and a curse”: a blessing because his mother had more time to fill out the form and a curse because it was difficult for him to juggle the FAFSA process with his demanding AP courses and college essays. Credit: Kavitha Cardoza for The Hechinger Report

Her classmate Carter, 18, is a serious student who is also on the baseball, wrestling and track teams. He has never wavered from his childhood decision to study biology. It began, he said, when he was about four years old, and his grandmother tuned to the National Geographic channel on TV.

“I was like, ‘stop, stop, stop,’ ” he said, recalling the video of a lion attacking a zebra. Carter was hooked. He started watching the channel every day. “I fell in love with ants, ecosystems, that just sparked my interest in biology.”

Carter applied to 14 colleges. He said filling out all the forms was challenging because the delayed release of the FAFSA meant he was doing it at the same time as he was taking a demanding course load, including AP Literature and AP Calculus. “It was really time-consuming and really work-heavy with a lot of essays, a lot of homework,” he said. “It’s pretty tough to do that at the same time while I’m doing college supplemental essays and my personal statement.”

But the FAFSA delay also meant that his mother had more time to finish the form, something she had been putting off for months. Because he is the oldest of four children, his mom hadn’t had to complete a form like this that asks for a lot of personal information, including tax data, he said.

“My mom was just brushing over it,” he said. “But I was like, ‘No, you really have to do this because this is for my future. Like, you don’t do this, I’ll have so much debt.’ So I was just telling her to please do this and please get on it.”

She did, but Carter said it likely wouldn’t have happened without the delay.

Carter got into his dream school, the University of Maryland, College Park, with a full scholarship, including tuition, meals and accommodation. His second choice, McDaniel College, also offered him a generous scholarship, but he says he still would have ended up paying $6,000 a year, which he didn’t want to do. “Definitely money was a big factor,” he said. He said he’s excited about starting a new chapter in September: “I feel like UMD is the perfect fit for me.”

GREENVILLE, S.C.

By Ariel Gilreath

Braden Freeman, a senior at J.L. Mann High School in Greenville, South Carolina, talks to his school counselor, Nicole Snow, about his plans after graduation. Credit: Ariel Gilreath/The Hechinger Report

Chylicia and Chy’Kyla Henderson worked hard to graduate early from Eastside High School in Greenville, South Carolina. The sisters filled their schedules and took virtual classes as well, so that Chylicia, now 18, could be done with school a semester early and Chy’Kyla, 17, could graduate after her junior year. Both want to attend college but need financial aid to afford it.

Their mom, Nichole Henderson, said the stress of trying to fill out both their FAFSA forms at once led her to take her daughters and two other graduating seniors she knew to a FAFSA workshop at a local college in April. Even with help from someone there, she found the forms confusing — Chylicia’s asked for Nichole’s tax information, she said, but Chy’Kyla’s did not.

“I don’t think there was a lot of help surrounding the whole FAFSA process,” Nichole said. “As a parent, it’s stressful. Especially when you have two.”

Chylicia is thinking about pursuing a degree in nursing or social work, and leaning toward starting at Greenville Technical College, a community college. But the school emailed her saying they needed more information on her financial aid application; it wasn’t clear if the issue stemmed from the FAFSA form or something else, she said.

Then, on May 8, she got an email from South Carolina Tuition Grants, a program that provides up to $4,800 in need-based scholarships, saying she was tentatively approved for the full amount. She still hasn’t resolved the paperwork issue at Greenville Technical College, though, and so isn’t sure yet whether she’ll be able to enroll there.

And if Chylicia’s application is missing information, the family worries that Chy’Kyla’s will have the same issue. Like her sister, she’s considering starting out at a community college, but Chy’Kyla also applied to a handful of schools in South Carolina, North Carolina and Georgia. By May 8, she said, she hadn’t received word about financial aid from any schools or any need-based scholarship programs.

“We’re just playing the waiting game,” their mother said.

Heather Williams, a school counselor at Riverside High School in Greenville, said students told her they struggled simply to complete and correct errors in their forms.

“Some of the errors they’ve had were just missing a signature,” Williams said. “Trying to circumvent that and fix it was hard for students because you can make corrections, but it was hard to get back in and [do it]. It was a lot of, ‘If I click this, then what?’ And being aware there’s an error, but not sure how to fix it.”

The FAFSA process has always been complicated, but the truncated timeline this year made it significantly more stressful, said Nicole Snow, a school counselor at J.L. Mann High School, also in Greenville County. Normally, her students and their families start filling out their FAFSA forms in the fall, but this year, they couldn’t access the form until January.

“By January and February, we’ve almost kind of lost those seniors that have already done their [college] applications,” she said. “Like, ‘Oh, let’s pull you back three months later and open up FAFSA.’”

Braden Freeman, a graduating senior at J.L. Mann High School in Greenville, South Carolina, was still waiting to hear back from some colleges about financial aid in May of 2024. Credit: Ariel Gilreath/The Hechinger Report

The delay created some challenging decisions for students like Braden Freeman. Freeman, who is the student body president at J.L. Mann, submitted his financial aid application in January, right after it opened up. In March, he was told he got a full scholarship to attend Southern Methodist University in Texas, but by May 1, he still hadn’t heard back from his other top choices — the University of North Carolina at Chapel Hill and the University of Virginia — on how much need-based and merit-based aid he would get. Those colleges had pushed back their decision deadlines because of FAFSA delays.

Instead of waiting to hear back from UNC and UVA, Freeman decided to put a deposit down at Southern Methodist, whose deadline was May 1. The full scholarship was a big factor in his decision. “With the rising cost of tuition, I just can’t take on that much alone,” he said.

Both UNC and UVA eventually sent Freeman his financial aid packages a week before their deadline to enroll, which was May 15. Freeman said he still planned to attend Southern Methodist.

“I’m fortunate enough to not be incredibly dependent on need-based aid,” Freeman said. “For kids that are waiting on that and don’t know, I can imagine that would be way worse.”

This story about FAFSA applications was produced by The Hechinger Report, a nonprofit, independent news organization focused on inequality and innovation in education. Sign up for the Hechinger newsletter.

The post Four cities of FAFSA chaos: Students tell how they grappled with the mess, stress appeared first on The Hechinger Report.

By Liz Willen For many high school seniors and others hoping to attend college next year, the last few months have become a stress-filled struggle to complete the trouble-plagued, much-maligned FAFSA, or Free Application for Federal Student Aid. The rollout of this updated and supposedly simplified form was so delayed, error-ridden and confusing that it

The post Four cities of FAFSA chaos: Students tell how they grappled with the mess, stress appeared first on The Hechinger Report. Higher Education, News, community college, Higher education access, Higher education affordability The Hechinger Report