Job ads dropped by 1.8% in February, according to SEEK’s latest Employment Report. However, Western Australia defied the national trend with a modest 0.4% increase, standing out as the broader Australian labour market shows signs of cooling.

Despite the dip in job ads, salary growth remained steady, with the SEEK Advertised Salary Index showing a 3.6% year-on-year increase, signaling a market caught between contraction and resilience.

Trades & Services (-3.9%) and Manufacturing (-3.4%) were the largest contributors to the February decline, reversing gains seen in January. However, Community Services (0.9%) and Administration (0.4%) posted modest increases. “January is traditionally a peak month for job ads,” Chapman explained, “so the February drop isn’t unexpected.” NSW (-2.4%), Queensland (-1.8%), and Victoria (-1.8%) were the biggest contributors to the national downturn. Victoria’s 12.2% year-on-year decline is most pronounced in Education and Healthcare, while South Australia’s retail crash reflects consumer caution. SEEK’s data aligns with ABS Labour Force trends, indicating that 2.5 million workers in hospitality and retail face uncertainty as job ads dry up.

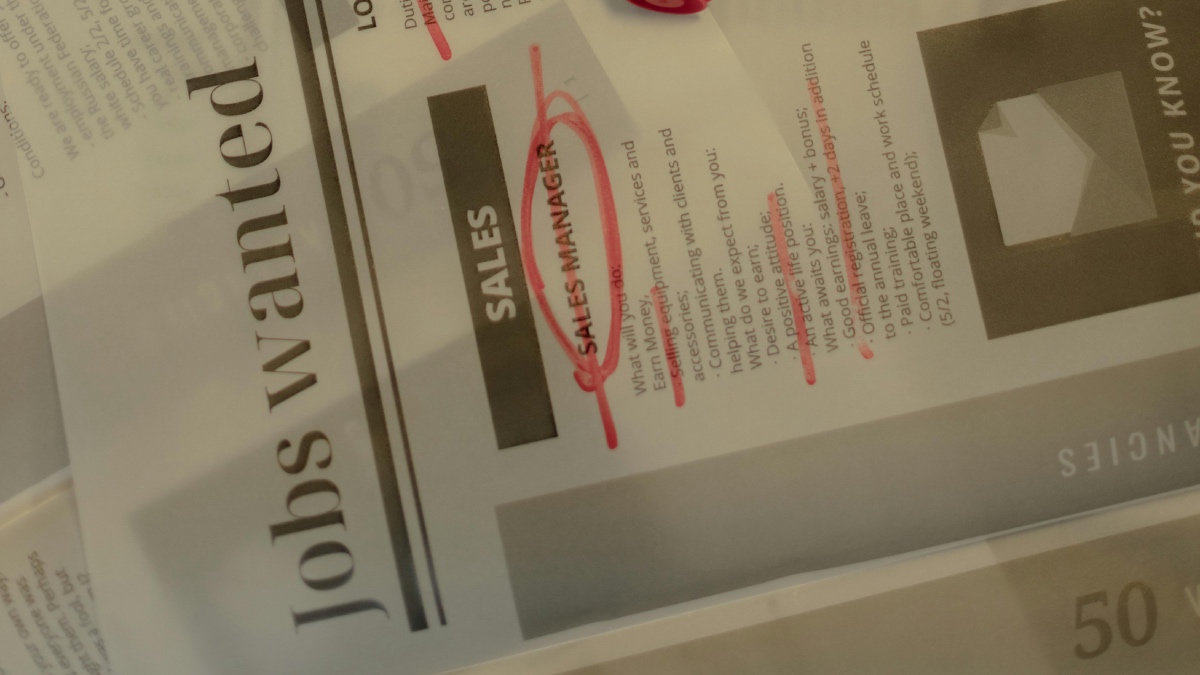

National job ads decline

After a strong January, SEEK data shows a 1.8% month-on-month drop in job ads, with regional areas (-3.8%) seeing a larger decline than urban centers (-1.5%). Year-on-year, job ads are down by 7.5%, but this is the smallest decline since before COVID, hinting at some stability in the market. South Australia saw the steepest drop (-4.4%), driven by a 22.6% decrease in Retail & Consumer Products. Victoria followed with a 12.2% annual decline, impacted by cuts in Education (-23.3%) and Healthcare (-19.1%).

However, Western Australia bucked the trend, rising by 0.4%, thanks to strong demand in Construction (7.1%) and Healthcare (5.0%). “WA’s strength in essential industries is noteworthy,” said SEEK Senior Economist Dr. Blair Chapman. The ABS reports WA’s unemployment rate at 2.1% (Feb 2025), well below the national rate of 4.1%.

WA’s mining industry, contributing $182 billion to exports provides a buffer, but lower commodity prices could test this advantage.

Steady salary growth

Despite the decline in job ads, advertised salaries grew by 0.3% month-on-month and 3.6% year-on-year, according to the SEEK Advertised Salary Index. “Salary growth has stabilized since November, although it is down 1.3 points from its peak in September 2023,” Chapman noted. At 3.6%, salary increases outpace inflation (2.8%, ABS, Jan 2025), although many households continue to feel cost pressures. Applications per job ad rose by 0.8% in January, particularly in Tasmania (11%), pointing to rising competition as fewer opportunities are available. “A more balanced market is emerging,” Chapman said, highlighting the impact of the RBA’s February rate cut—the first since 2020.

With 30% of SMEs failing within three years consistent salary growth could attract talent to stable sectors like WA’s Construction industry.

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

Job ads fell 1.8% in February, but WA rose 0.4%, defying the slump. Salaries steady at 3.6%—is the West hiding Australia’s job secret? News, Job Ads Dynamic Business